THE SPECIFICS TO CANADA’S EMPLOYMENT STANDARDS ACT

Nunzio Presta

Nunzio Presta

Senior Sales and Marketing Executive

THE DIFFERENT EMPLOYMENT STANDARDS

Laws of every province may have some similarities because they have common law jurisdictions, but even so, their differences lie in the details of each law passed.

Quebec though, is an exception as they are still using a European-style civil law system in their province. On the other hand, industries in all of Canada that are federally governed are following the federal employment laws instead.

One example of an employee benefit that each provincial employment law mandates is the annual leave. All implemented provincial law gives every employee 2 weeks of vacation after 12 months of employment, except in Saskatchewan, which mandates 3 weeks of vacation, and Quebec, which gives 1 day per month.

Below is a list of federal, provincial and territorial employment standards in Canada that you can click on to learn more about.

- Provincial Standards

- Alberta Employment Standards

- British Columbia Employment Standards

- Manitoba Employment Standards

- New Brunswick Employment Standards

- Newfoundland Employment Standards

- Nova Scotia Employment Standards

- Ontario Employment Standards

- Prince Edward Island Employment Standards

- Québec Employment Standards

- Saskatchewan Employment Standards

- Territorial Standards

SOME IMPORTANT SPECIFICS THAT EVERY EMPLOYMENT STANDARD COVERS

As mentioned earlier, every province and territory has their own employment standards. Their rules and regulations are mostly the same, but have differences when it comes to certain details.

It is important to know the specifics of the province where your employee is located. In some cases, a class suit could be filed against a company and be penalized for not meeting the minimum requirements of the employment standards.

Let’s tackle some of these items to get a better understanding of Canadian employment standards:

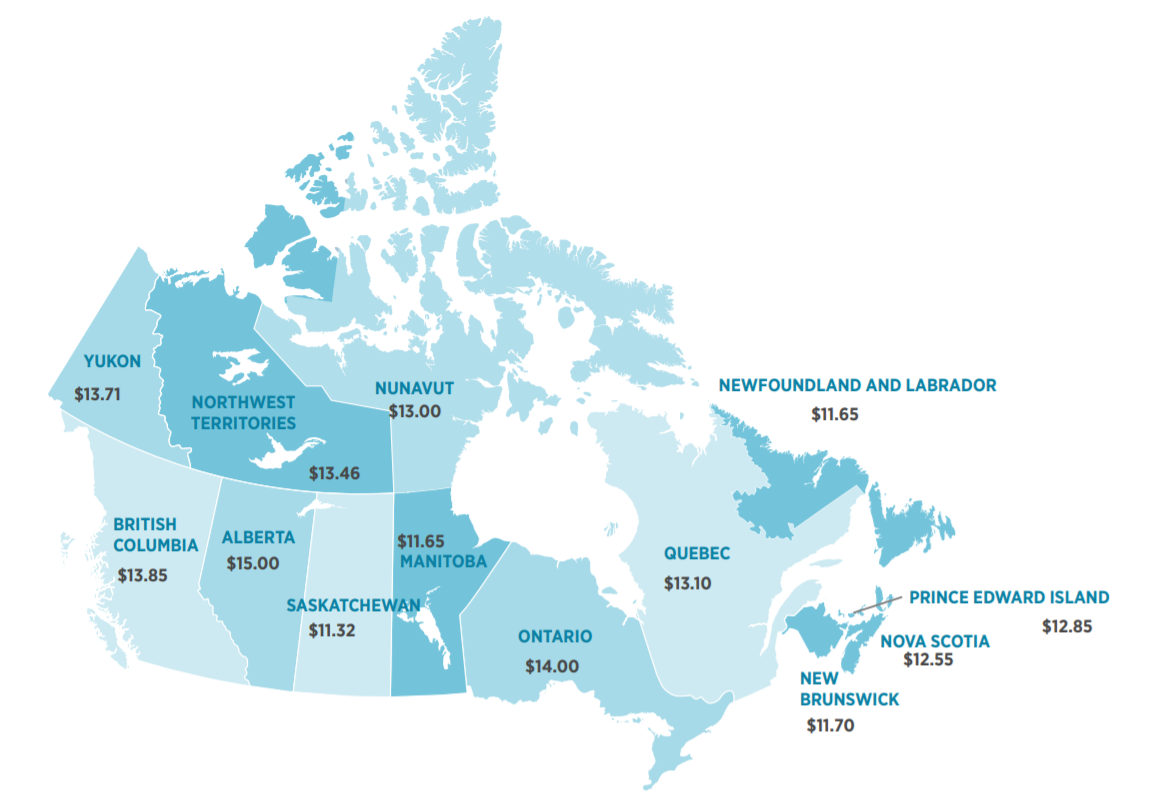

MINIMUM WAGE

Every province in Canada has their own minimum wage per hour. There are some provinces which have a different minimum wage for student workers like in Alberta where the regular minimum wage is $15/hour, but students under 18 years of age earn only $13/hour.

See the table below for the minimum wage per hour in every province and territory in Canada. Take note that every rate is in Canadian dollars.

|

Province |

Minimum Wage per Hour |

|

Alberta |

$15.00 General Workers $13.00 Student Under 18 (less than 28 hrs/wk when school is in session) |

|

British Columbia |

$13.85 General Workers ($14.60 June 1, 2020) $12.70 Liquor Servers ($13.95 June 1, 2020) |

|

Saskatchewan |

$11.32 |

|

Manitoba |

$11.65 |

|

Ontario |

$14.00 General Workers $12.20 Liquor Server $13.15 Student Under 18 (less than 28 hrs/wk) |

|

Québec |

$13.10 $10.45 If Gratuities Apply |

|

New Brunswick |

$11.70 |

|

Nova Scotia |

$12.55 Experienced workers $11.05 Inexperienced workers |

|

Prince Edward Island |

$12.85 |

|

Newfoundland and Labrador |

$11.65 ($12.15 October 1, 2020) |

|

Yukon |

$13.71 |

|

Northwest Territories |

$13.46 |

|

Nunavut |

$16.00 |

|

Federal Rate |

Prevailing rate of province in which work is performed |

Courtesy of the Retail Council of Canada

OVERTIME PAY

The usual overtime rate in every Canadian province is 1.5 times the hourly rate of the employee and is typically paid after exceeding the 40 hours per week. Though, there are some provinces that pay overtime pay after exceeding 44 or 48 hours of work per week.

There are also some provinces which allow the employees to get additional time off in compensation for their overtime instead of being paid overtime pay. Some provinces that allow this are Alberta and Quebec.

See the table below for the different payment structure of overtime pay per province.

|

Province |

Overtime Pay per hour |

|

British Columbia |

Daily: Hourly rate x 1.5 after 8 hours, double time after 12 hours |

|

Weekly: Hourly rate x 1.5 after 40 hours |

|

|

Alberta |

Hourly rate x 1.5 (after 44 hours/week) |

|

Saskatchewan |

Hourly rate x 1.5 (after 8 or 10 hours a day or 40 hours a week) |

|

Manitoba |

Hourly rate x 1.5 (after 40 hours/week) |

|

Ontario |

Hourly rate x 1.5 (after 44 hours/week) |

|

Quebec |

Hourly rate x 1.5 (after 40 hours/week) |

|

New Brunswick |

Not less than minimum wage x 1.5 (after 44 hours/week) (minimum overtime wage rate is $17.25) |

|

Nova Scotia |

Hourly rate x 1.5 (after 48 hours/week) |

|

Prince Edward Island |

Hourly rate x 1.5 (after 48 hours/week) |

|

Newfoundland and Labrador |

Minimum overtime wage $17.10 in excess of 40 hours/week |

|

Yukon |

Hourly rate x 1.5 after 8 hours a day or 40 hours/week |

|

Northwest Territories |

Hourly rate x 1.5 after 8 hours a day or 40 hours/week |

|

Nunavut |

Hourly rate x 1.5 after 8 hours a day or 40 hours/week |

|

Federal Rates |

Hourly rate x 1.5 after 8 hours a day or 40 hours/week |

STATUTORY AND PROVINCIAL HOLIDAYS

Each province in Canada celebrates their own holidays on top of statutory holidays. For holidays, employees are entitled to be given a time off on that day but some provinces allow them to take it on a different agreed day if they need to work.

In case the employee needs to work on a holiday, they will be paid a premium of 1.5 days on top of their daily wage. So if your employee is working 8 hours a day, they will be paid for 20 hours for working on a holiday.

That is how stat holiday pay is computed for most provinces. But in Newfoundland, employees are paid their regular daily wages plus the holiday pay which is 2 times their regular pay. It’s like earning 3 days worth of wage just for one day’s work.

Here are the days when your Canadian employee could be earning their holiday pays:

- New Year’s Day

- Good Friday (Quebec has the option of choosing Easter Monday)

- Victoria Day (National Patriots’ Day in Quebec)

- Canada Day

- Labour Day

- Thanksgiving Day

- Remembrance Day (some provinces only)

- Christmas Day

- Boxing Day (Ontario only)

- Provincial or civic holiday in the area where the business is

PAID VACATIONS

Once your employee reaches 12 months of being employed in your company, they will be entitled to an annual 2 weeks of paid vacation. The vacation pay will be equal to 4% of their annual gross wage.

This is the general standard for every province, although Saskatchewan gives 3 weeks of paid vacation after 12 months of employment. The days and vacation pay increases every specific number of employment years depending on the province.

Every employee, either part-time, full-time or student employee, is entitled to get vacation entitlements and pay. Depending on the agreement and the province or territory, employees can take their vacation in one go or split it on different dates. If they choose to split their dates, they will be paid on a prorated basis depending on the number of days they take.

LEAVES OF ABSENCE

Canadian workers are entitled to be able to request work leaves for personal reasons, life events or unusual circumstances. These leaves could be paid or unpaid depending on the length of leave or the arrangement.

Some common reasons for an employee to request leave are pregnancy/maternity, illness and bereavement. They may also take a leave to participate in provincial or national voting.

On the other hand, reporting for military duty or court/jury duty are some uncommon reasons for leave requests. If your employee is an Aboriginal, they may also take on leave to participate in their traditional Aboriginal practices like hunting or fishing.

TERMINATION OF EMPLOYMENT

Unlike in the US, Canada doesn’t have “at-will” employment. Every worker, whether part-time or full-time, has a contract that follows the employment standards. So as part of the contract, every termination will undergo a process and should be based on the law.

The termination process could be a “Termination With Cause” if the termination is due to serious misconduct or “Termination Without Cause” if the reason for termination is not related to misconduct.

Once you decide to terminate your employee, a termination notice should be given ahead of time and the employee will work until the end date on the notice. Another option is terminating the employee immediately with a lump sum payment in lieu of working notice.

Another important document to provide as well is their termination letter. If this letter or the other discussed items are not provided, a class suit could be filed against your company as it could be a violation of the employment standards.

CONCLUSION

Canada does have different employment standards per province and territory. Each has their own differences when compared to the details of the other standards, but they are still fair due to being made under the same jurisdiction.

If you will be an employer to a Canadian citizen, it’s best to learn the right employment standard of the province where your business is located. This is to make sure that all the specific details that you should be following is actually followed.

Canada does take their employment standards very seriously as they want all their working citizens to be protected. They also make sure that employees get the benefits they deserve and expect all employers to abide by these standards.